Just last week, I found myself opening a new bank account – a process that, as many of you know, can be quite the paper chase. After signing what felt like a mountain of documents, I was finally ready for the last step: downloading the bank's app for convenient access to my account. As I tapped the "Install" button, a nagging question popped into my head: "Are mobile banking apps actually safe?"

Mobile banking apps are generally safe due to encryption, authentication features, and regular updates. However, risks remain from phishing attacks, malware, weak passwords, and unsecured public Wi-Fi eavesdropping. Users should adopt cybersecurity best practices for optimal security.

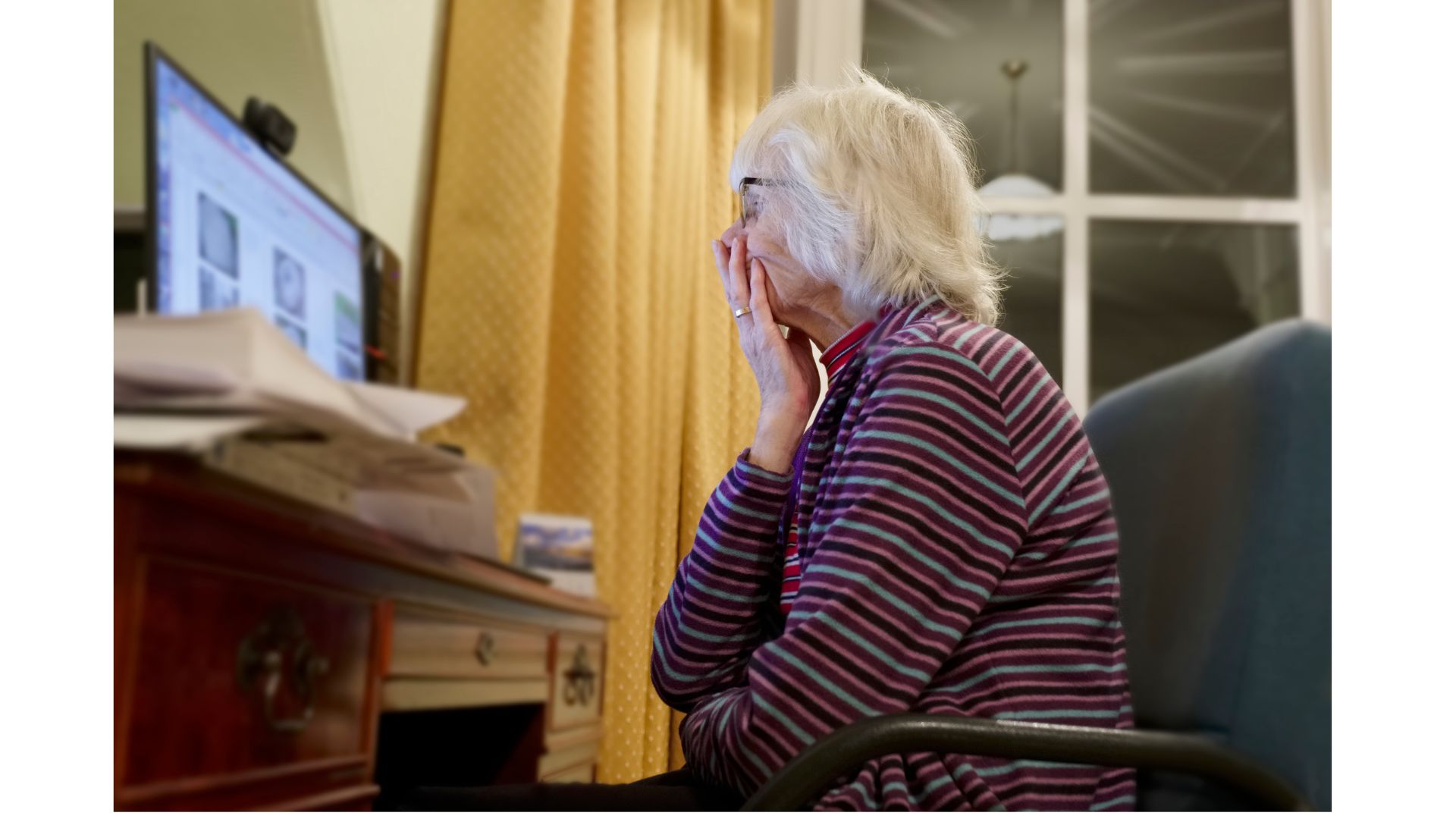

As we increasingly depend on smartphones for crucial tasks, including financial management, we must consider the safety of mobile banking apps. Are we putting our hard-earned money at risk? Join me as I explore the security of mobile banking apps and help you decide whether convenience truly outweighs potential risks.

Why Mobile Banking Apps?

Mobile banking apps have become a staple in the modern banking experience. They're designed to offer you an easy and convenient way to manage your finances right from your smartphone.

These apps typically allow you to check your account balances, review transaction history, transfer funds between accounts, pay bills, and even deposit checks using your phone's camera. Some advanced features include budgeting tools, customized alerts, and integration with third-party apps.

Now, how do they work? Mobile banking apps connect to your bank's online servers through a secure internet connection. Banks employ robust encryption and authentication technologies to ensure the privacy and security of your financial data.

These measures protect your information from unauthorized access while it is transmitted between your phone and the bank's servers.

Security Measures in Mobile Banking Apps to Keep Your Money Safe

We get it – guarding your precious savings against crafty hackers is a big deal. Thankfully, banks and app developers are on the case, working round the clock to ensure mobile banking apps stay secure. Curious about the nifty defense tactics they use? Let's dive in:

Encryption and secure communication protocols

Your banking app always shares sensitive information with the bank’s server. To keep the financial data safe, mobile banking apps use encryption to encode your information, making it unreadable to hackers and anyone trying to intercept it.

One of the widely used encryption methods is SSL/TLS (Secure Socket Layer/Transport Layer Security) – the same technology used to protect websites when you see a padlock symbol in your browser's address bar.

Authentication and login security features

Mobile banking apps usually provide multiple layers of authentication to ensure that only authorized users can access the account. Common authentication methods include:

Username and password: A combination of your unique username and a strong, complex password provides a basic level of security.

Two-factor authentication (2FA): This adds an extra layer of protection by requiring a second verification form, such as a one-time code sent to your phone via SMS or an authenticator app.

Biometrics: Some banking apps also offer biometric authentication, which uses your fingerprint or facial recognition to verify your identity.

Automatic updates and patches

No software is perfect, and vulnerabilities can be discovered over time. Banks and app developers are constantly monitoring and improving their mobile banking apps and rolling out updates to fix any security holes they find.

To ensure you're using the most secure version of your banking app, enable automatic updates or check for updates manually through your device's app store.

Common Mobile Banking App Security Issues and Threats

While mobile banking apps do their best to keep your money safe, it's essential to stay aware of the risks lurking in the shadows. Cybercriminals are constantly crafting new tactics to break through digital defenses.

In this section, we'll explore some of the most common security issues and threats you might encounter when using mobile banking apps.

Phishing attacks

Phishing scams are devious tricks used by cybercriminals to steal your sensitive information, like login credentials and banking details. They might send you an email or text message, posing as your bank, with a seemingly legitimate request to "confirm your details" or "update your account."

Be cautious! Clicking on links in these messages can lead you to a fake website designed to capture your information.

I was once a victim of a phishing attack, and it made me feel foolish. It all began with a phone call from someone claiming to be an Amazon representative, offering to issue me a refund. Despite numerous warning signs, such as not having requested a refund, I was oblivious and gave the person my Amazon password.

Fortunately, this incident didn't happen on my banking app; otherwise, the consequences could have been far worse.

It's crucial to remember that those who orchestrate phishing attacks are highly skilled at appearing genuine. Never let your guard down, and always be wary of suspicious requests. Always verify the sender's identity and use your bank's official website or app to manage your account.

Unsecured Wi-Fi connections

Public Wi-Fi hotspots are convenient, but they can also be dangerous. When you use an unsecured Wi-Fi connection, hackers may intercept your data, eavesdrop on your transactions, or even hijack your session. To protect yourself, avoid using public Wi-Fi for mobile banking, or use a virtual private network (VPN) to encrypt your connection and keep your transactions secure.

Malware

Malware is malicious software designed to infiltrate and damage devices or steal sensitive information. Cybercriminals can use it to gain unauthorized access to your mobile banking app or monitor your activity.

To protect yourself, only download apps from reputable sources, keep your device's operating system up-to-date, and install a trustworthy antivirus app to scan for malware regularly.

Weak passwords and compromised credentials

Weak passwords make it easy for hackers to access your mobile banking app. To minimize this risk, create a strong, unique password for each of your accounts. Combine uppercase and lowercase letters, numbers, and symbols to make it harder for cybercriminals to crack.

Additionally, avoid using the same password across multiple accounts and change your passwords regularly. Implement multi-factor authentication whenever possible for an extra layer of security.

Countless Hearts Shattered: Mobile Banking App Scams

One quick online search for "mobile banking app scams" reveals the gut-wrenching reality of countless victims who have suffered devastating financial losses.

One particularly heart-wrenching tale involves Jacopo de Simone, whose story was brought to light by the BBC UK news outlet. As reported, a pickpocket snatched Jacopo's mobile phone and mercilessly exploited his banking apps to pilfer a staggering $24,500 from both his current and savings accounts. Despite reporting the fraud to his bank, they ultimately held him liable.

As someone with a savings account, I cherish my growing emergency fund, inspired by the wisdom of financial gurus such as Dave Ramsey. The mere thought of having that hard-earned money stolen makes my blood run cold.

It's easy to empathize with Jacopo's heartache as he was stripped of his financial security in the blink of an eye.

Jacopo's tragic experience echoes the unsettling findings of the South African Banking Risk Information Centre (SABRIC). The organization reveals that cell phone theft has fueled a sinister surge in banking app fraud.

Today's criminals are no longer satisfied with the mere physical value of the cell phones they steal but are rather eyeing the banking apps and financial data stored on the phones.

If you've been ensnared by any type of mobile banking app scam, don't let shame silence you. Today's scams are more complex and persuasive than ever before.

As we stand together in solidarity with Jacopo and countless others like him, let us arm ourselves with knowledge and implement safeguards to prevent the heartache of becoming yet another victim.

Tips for Staying Safe While Using Mobile Banking Apps

Keeping your app and device updated: Regular updates not only introduce new features and improvements but also fix security vulnerabilities. Keep your mobile banking app and your smartphone's operating system updated to the latest version to protect you from known threats.

Using strong, unique passwords: Create complex strong passwords for your mobile banking app. Follow password best practices, such as avoiding using the same password for multiple accounts. Use biometric data ID if possible.

Use different PIN numbers to unlock your phone and access banking apps.

Don't store passwords or PIN numbers on your phone.

Being cautious of phishing attempts and scams: Always be vigilant when receiving unsolicited messages or emails about your bank account. Avoid clicking on links or downloading attachments from unknown sources. If you're unsure about a message's authenticity, contact your bank directly to verify the information.

Only use secure Wi-Fi networks: Refrain from accessing your mobile banking app on public Wi-Fi networks or use a VPN to encrypt your connection. This will help protect your financial data from potential eavesdropping and interception.

In wrapping things up, mobile banking apps have truly changed the game for managing our finances, making our lives so much easier and more convenient.

Although these handy apps come with a bunch of security measures to keep our money safe, we can't ignore the fact that scams and fraud still happen.

We've taken a look at the emotional impact these scams have on people and shared some helpful tips for staying safe while using mobile banking apps.

At the end of the day, it's up to us to stay in the know and be careful when using these apps.

By sticking to the safety guidelines and keeping our eyes peeled, we can minimize the risks and keep enjoying the perks of this awesome financial tech while making sure our hard-earned money stays right where it belongs!